The Union Budget 2025 has introduced significant changes in tax policies, financial planning, and government spending. One of the most important announcements is that individuals earning up to ₹12 lakh per annum will not have to pay any income tax. This move aims to provide major relief to the middle class and salaried individuals. Below, we analyze the key tax slab changes, new exemptions, and other budget highlights.

Revised Income Tax Slabs for AY 2025-26

The government has revamped the tax slabs, ensuring greater tax relief for individuals earning up to ₹12 lakh per annum. Here is a comparison of the old and new tax slabs.

New Tax Slabs for FY 2025-26

| Income Range | Old Tax Rate (FY 2024-25) | New Tax Rate (FY 2025-26) |

| Up to ₹3,00,000 | NIL | NIL |

| ₹3,00,001 – ₹6,00,000 | 5% | NIL |

| ₹6,00,001 – ₹9,00,000 | 10% | NIL |

| ₹9,00,001 – ₹12,00,000 | 15% | NIL |

| ₹12,00,001 – ₹15,00,000 | 20% | 15% |

| Above ₹15,00,000 | 30% | 25% |

These new tax slabs ensure that individuals earning below ₹12 lakh annually will be exempt from paying income tax.

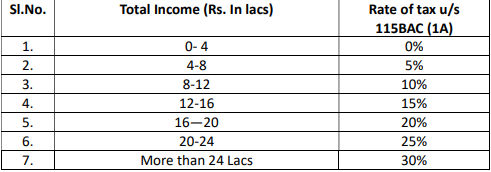

Marginal Relief in the New Tax Regime

Marginal relief is available to resident individuals with income slightly exceeding ₹12 lakh. This ensures that those earning slightly above the threshold do not face a steep increase in tax liability.

Marginal Relief Calculation

| Income (₹) | Tax Without Marginal Relief (₹) | Tax Payable After Marginal Relief (₹) |

| 12,10,000 | 61,500 | 10,000 |

| 12,50,000 | 67,500 | 50,000 |

| 12,70,000 | 70,500 | 70,000 |

| 12,75,000 | 71,250 | 71,250 (No relief) |

How Marginal Relief Works

-

Tax is first computed as per the slab rates.

-

The income exceeding ₹12,00,000 is compared with the tax liability.

-

The taxpayer is required to pay only the marginal amount exceeding ₹12,00,000.

-

The maximum rebate available under marginal relief is ₹60,000.

-

Marginal relief is available only up to an income of ₹12,75,000.

-

It does not apply to special income such as capital gains or lottery winnings.

Key Highlights of Budget 2025

1. Standard Deduction and Tax Exemptions

-

The standard deduction has been increased from ₹50,000 to ₹75,000, benefiting salaried individuals and pensioners.

-

Section 80C exemptions remain unchanged at ₹1.5 lakh, but additional deductions under Section 80D for health insurance have been increased.

2. Corporate Tax and Startups

-

The corporate tax rate for companies with turnover below ₹250 crore remains at 25%.

-

Startup tax incentives have been extended for another three years, providing tax relief for emerging businesses.

3. GST & Indirect Tax Changes

-

GST on essential items like medical supplies and food products has been reduced.

-

Luxury goods and non-essential imports face an increased tax rate to boost domestic manufacturing.

New Government Schemes & Policies

| Scheme Name | Old Benefits | New Benefits in Budget 2025 |

| PM Kisan Yojana | ₹6,000 per year | ₹8,000 per year |

| Home Loan Subsidy | 3% subsidy for ₹30 lakh loans | 4% subsidy for ₹35 lakh loans |

| MSME Loan Scheme | ₹2 crore loan limit | ₹3 crore loan limit |

Impact on Different Sectors

1. Middle-Class & Salaried Individuals

-

Increased standard deduction leads to higher tax savings.

-

Reduction in middle-income tax rates boosts disposable income.

2. Businesses & Startups

-

Extended startup incentives encourage new businesses.

-

Lower tax rates on SMEs improve cash flow.

3. Investors & Markets

-

No major changes in capital gains tax, but long-term investors benefit from tax exemptions in some asset classes.

-

Stock market reacts positively to pro-business tax policies.

Ans. New regime provides for concessional tax rates and liberal slabs. However, no

deductions are allowed in the new regime (other than those specified for e.g. 80JJAA, 80M,

standard deduction).

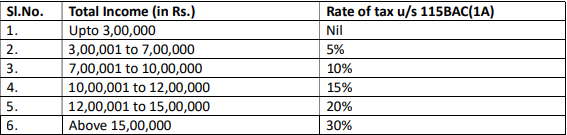

Ans. The Finance (No.2) Act, 2024 had the following slabs in the new tax regime for person,

being an individual or Hindu undivided family or associaƟon of persons [other than a cooperaƟve society], or body of individuals, whether incorporated or not, or an arƟficial juridical

person referred to in sub-clause (vii) of clause (31) of secƟon 2:

Ans. The new slabs proposed are as under:

For income above 12 lac, in the case of resident individuals, marginal relief shall be

allowable .

NIL.

Ans. In the proposed new tax regime, the maximum total income for which tax liability for

individual taxpayers is NIL is Rs. 12 lakhs.

be taken?

Ans. The benefit of such Nil tax liability menƟoned above is available only in the new tax

regime. This New tax regime is the default regime. To avail the benefit of rebate allowable

under proposed provisions of new tax regime, only return is to be filed otherwise no other

step is required to be taken.

Ans. New tax regime is applicable to person, being an individual or Hindu undivided family or

associaƟon of persons [other than a co-operaƟve society], or body of individuals, whether

incorporated or not, or an arƟficial juridical person referred to in sub-clause (vii) of clause (31)

of secƟon 2. Accordingly, change in tax slabs will benefit all these persons.

Ans. Any individual earlier was required to pay a tax of Rs 80,000 (in the new regime) for

an income of Rs. 12 lacs. Now he will be required to pay nil tax on such income.

Conclusion

The Budget 2025 focuses on tax relief, economic growth, and investment incentives. With new income tax slabs for AY 2025-26, taxpayers earning below ₹12 lakh per year can enjoy tax-free income, significantly boosting disposable earnings. Marginal relief ensures that those earning slightly above ₹12 lakh do not face excessive taxation. Stay updated with the latest government policies to make informed financial decisions.